income tax rates 2022 australia

The top marginal income tax rate of 37 percent will hit taxpayers with taxable. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income.

60 000 After Tax Au Breakdown May 2022 Incomeaftertax Com

This page provides - Australia Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news.

. In most cases your employer will deduct the income tax from your wages and pay it to the ATO. For your company to be a base rate entity it needs to meet the. The income tax brackets and rates for Australian residents for this financial year.

Income tax calculator 2021-22 financial year October 18 2021. 2022 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in Australia. There are seven federal income tax rates in 2022.

In July 2034 your. 19c for each 1 over 18200. In July 2034 your income will fall below the minimum threshold Final payment date.

In addition foreign residents do not pay the Medicare Levy or receive the Low Income Tax Offset LITO. Tax Rates 2022-2023. The maximum tax offset of 70000 applies if your taxable income is 3700000 or less.

If your company is a base rate entity your company tax rate is 25 from the 202122 income year onwards. 19c for each 1 over 18200. Australia has a bracketed income tax system with five income tax brackets ranging from a low of 000 for those earning under 6000 to a high of 4500.

Personal Income Tax Rate in Australia averaged 4544 percent from 2003 until 2020 reaching an all time high of 47 percent in 2004 and a record low of 45 percent in 2007. Also as part of the 3-step plan the Government has increased the existing Low Income Tax Offset LITO from AUD 455 to AUD 700. You are viewing the income tax rates thresholds and allowances for the 2022 Tax Year in Australia.

Median household income australia 2022 05142022. A base rate entity for an income year is a company which meets the following criteria. Tax on this income.

5092 plus 32. 2022 tax rates thresholds and allowance for individuals companies trusts and small business corporations sbc in australia. Low Income Tax Offset in 2023.

Australian residents pay different rates of tax to foreign residents. Australian residents pay different rates of tax to foreign residents. 5092 plus 32.

If you are looking for an alternative tax year please select one below. The maximum rate was 47 and minimum was 45. Tax Rates 2021-2022.

The company tax rate for base rate entities has fallen from 275 to 26 in 20202021 financial year and is now down to 25 for 20212022 and later income years. 12 May 2022. Base rate entity company tax rates.

For the 2016-17 financial year the marginal tax rate for incomes over 180000 includes the Temporary Budget Repair Levy of 2. Median household income australia 2022. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

In addition foreign residents do not pay the Medicare Levy or receive the Low Income Tax Offset LITO. The maximum tax offset of 70000 applies if your taxable income is 3700000 or less. These include companies corporate unit trusts and public trading trusts.

Income you must. In the long-term the Australia Personal Income Tax Rate is projected to trend around 4500 percent in 2022 according to our econometric models. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

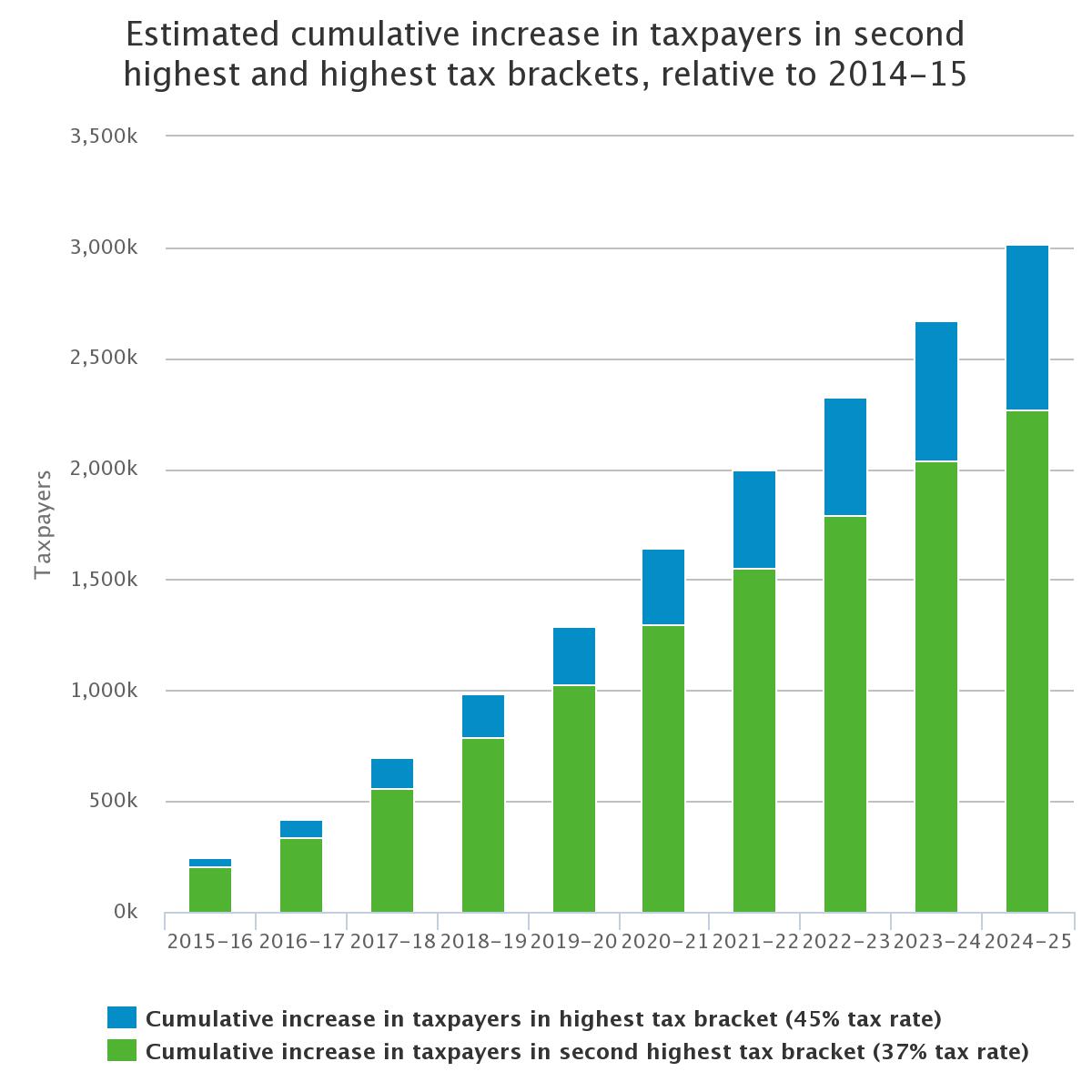

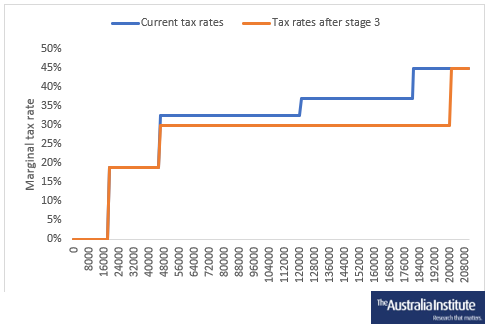

Individual tax rates 2022 australia. The next phase of the tax cuts will eventually remove the 325 and 37 marginal tax rates which will result in around 94 of Australian taxpayers facing a marginal tax rate of 30 or less in the 202425 and later income years. The maximum rate was 47 and minimum was 45.

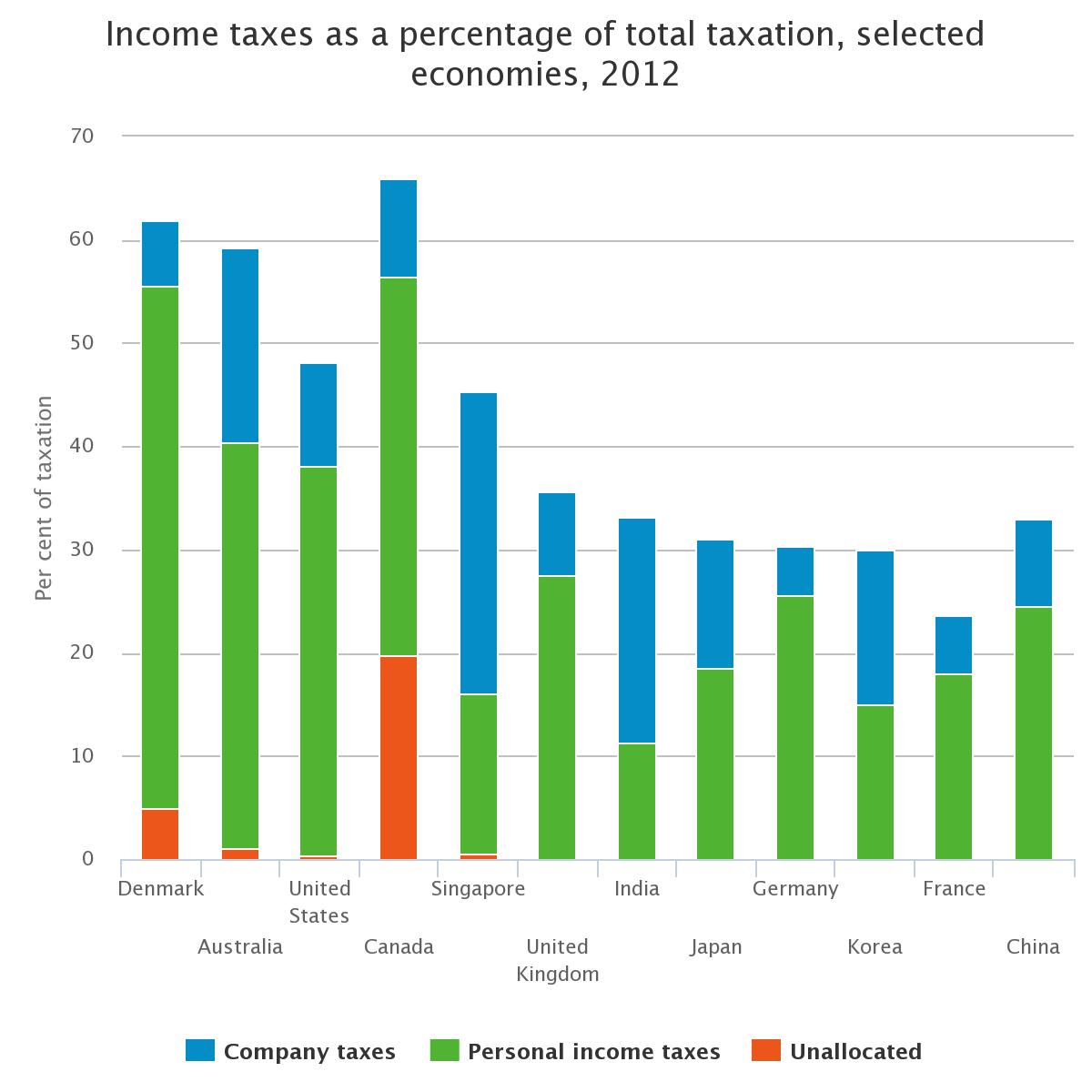

Did you know that reduced tax rates may be available to eligible entities. Tax Rates 2021-2022 Year Residents Tax Scale For Year Ended 30 June 2022 Taxable IncomeTax On This Income 0 to 18200 Nil 18201 to 45000 19c for each 1 over 18200 45001 to 120000 5092 plus 325c for each 1 over 45000 120001 to 180000 29467 plus 37c for each 1 over 120000 180001 and over 51667 plus 45c for. The maximum income tax rate in Australia of 4500 ranks Australia as one of the ten highest taxed countries in the world.

In Australia financial years run from 1 July to 30 June the following year so we are currently in the 202122 financial year 1 July 2021 to 30 June 2022. The following tables sets out the PIT rates that currently apply to resident and non-resident individuals for the. Data published Yearly by Taxation Office.

Australian income tax brackets and rates for 2021 and 2022. This includes a link to our fuel tax credit calculator to help you report amounts on your business activity statement. The Personal Income Tax Rate in Australia stands at 45 percent.

If your taxable income is less than 6666700 you will get the low income tax offset. State income tax is different from the federal income tax. There were further amendments in 2019.

Tax on this income. Countries with similar tax brackets include Portugal with a maximum tax bracket of 4600 Austria with a maximum tax bracket of 5000 and United Kingdom with a maximum tax bracket of 5000. 2020-2021 pre-budget reflects the tax rates prior to those announced in the Budget in October 2020.

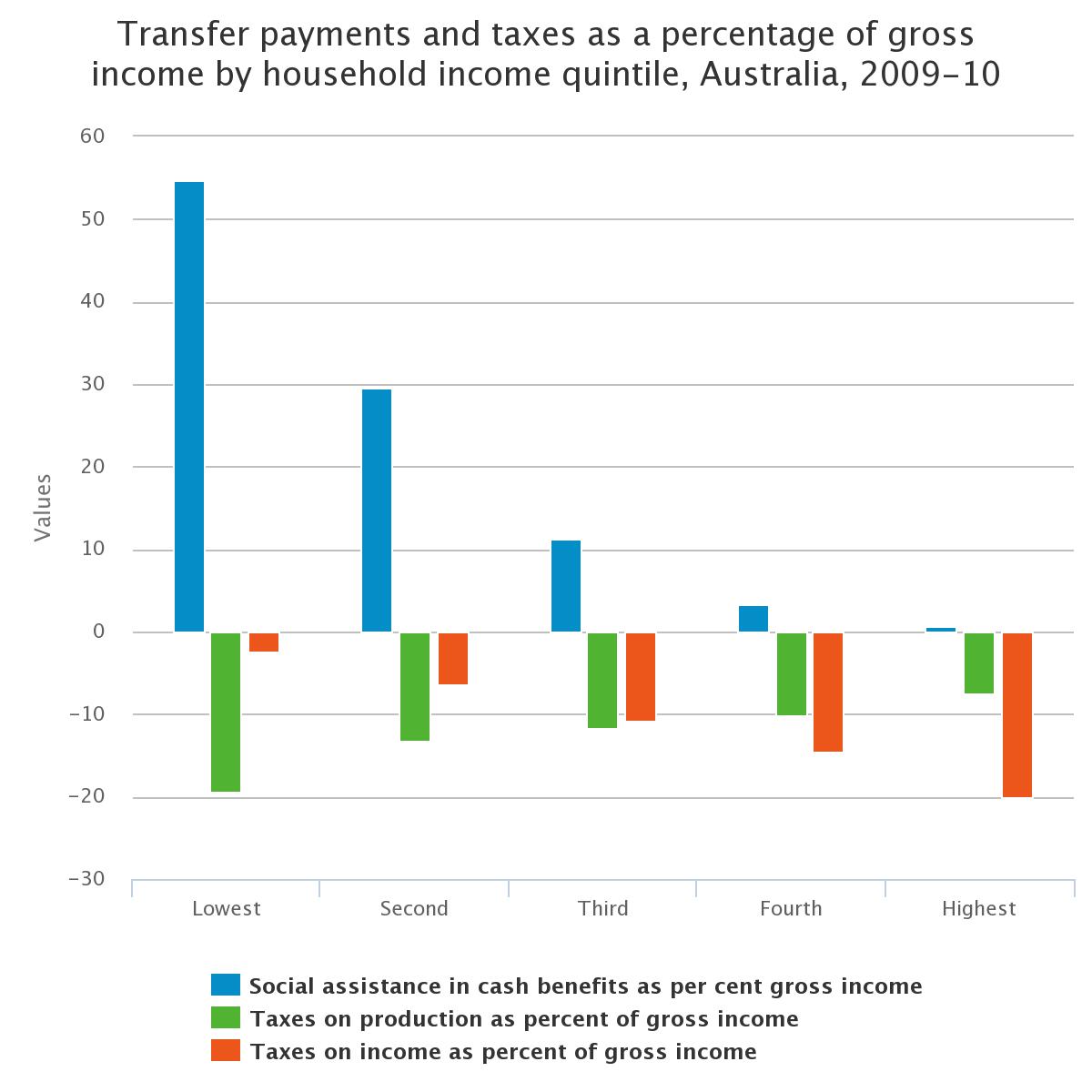

However for companies with an aggregate annual turnover of less than AUD 50 million that derive no more than 80 of their assessable income from base rate entity passive income the tax rate is 25 for the 2021-22 and subsequent income years reduced from 26 for the 2020-21 income year. The LITO will be recovered at a rate of 5 cents per dollar between taxable incomes of AUD 37500 and AUD 45000 and an additional 15 cents per dollar from taxable incomes between AUD 45001 and AUD 66667. You may be eligible for a tax offset in 2022 if you are a low-income earner and you are an Australian resident for income tax purposes.

Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1 July 2022 to 30 June 2024 which include an expansion of the 19 rate initially to 41000 and lifting the 325 band ceiling to 120000. Owner-occupier rate last published by the Reserve Bank of Australia before the start of the income year. From 30 March 2022Fuel tax credit rates from 30 March 2022 to 30 June 2022.

If your taxable income is less than 6666700 you will get the low income tax offset. What is personal tax rate in Australia. Australias income tax system is undergoing a radical overhaul designed to reduce tax for the majority of individuals protect middle-income earners from bracket creep and simplify the system.

Low Income Tax Offset in 2022. The companys aggregated turnover for that income year. A subsequent Budget 2019 measure further expanded the 19 income ceiling.

Personal Income Tax Rate in Australia remained unchanged at 45 in 2021. You may be eligible for a tax offset in 2023 if you are a low-income earner and you are an Australian resident for income tax purposes. The corporate income tax rate generally is 30.

Australia Medicare Card Template In Psd Format Fully Editable Gotempl Templates With Design Service In 2022 Medicare Templates Document Templates

Sample Resume Civil Engineer Australia Resume Sample 90 Engineering Resume Resume Template Australia Resume Writing Services

Australian Income Tax Brackets And Rates For 2021 And 2022

The Presentation Explains Tax Aspects Of Accounting In Australia Computation Of Taxable Inf Accounting Services Small Business Accounting Bookkeeping Services

Tax Brackets Australia See The Individual Income Tax Tables Here

What Are The Current Marginal Tax Rates Canstar

Ten Reasons Why The Arguments Against Increasing Tax Are Wrong The Australia Institute

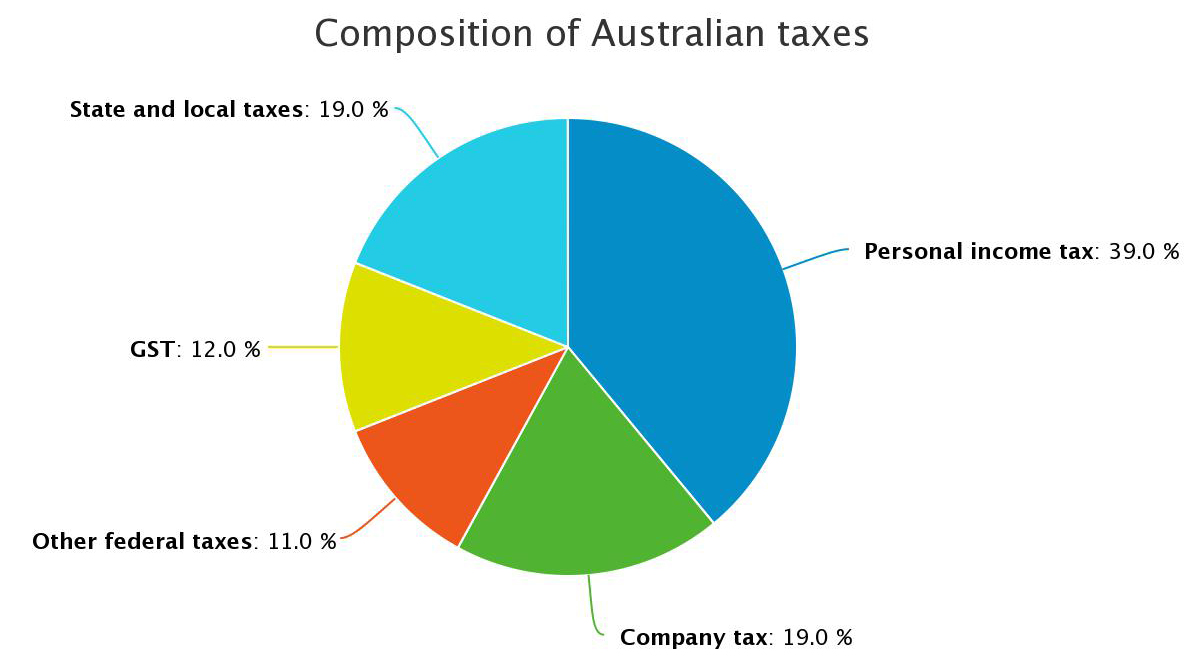

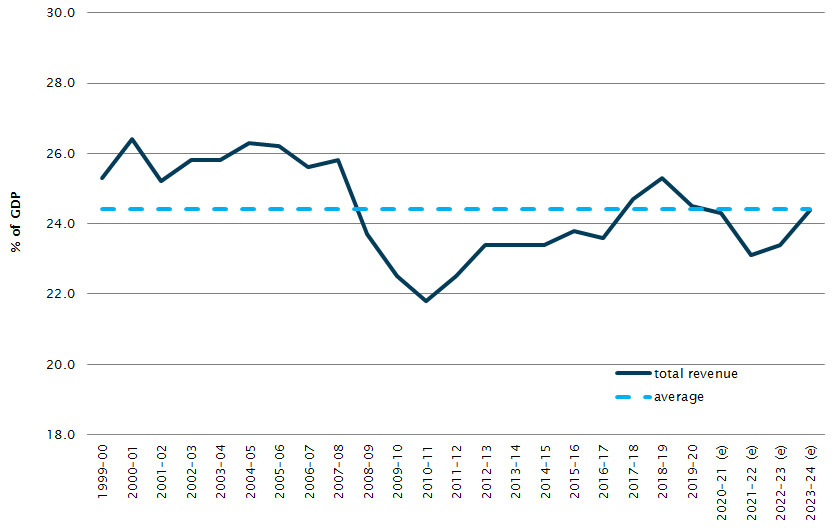

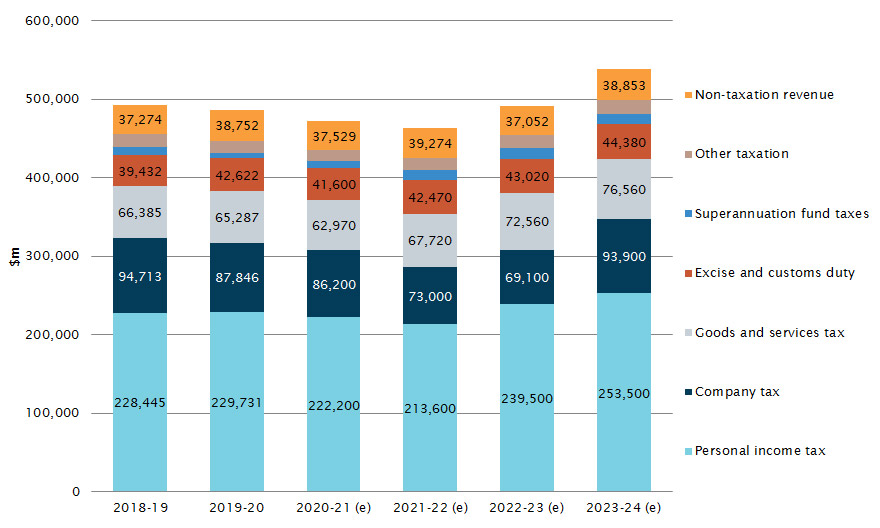

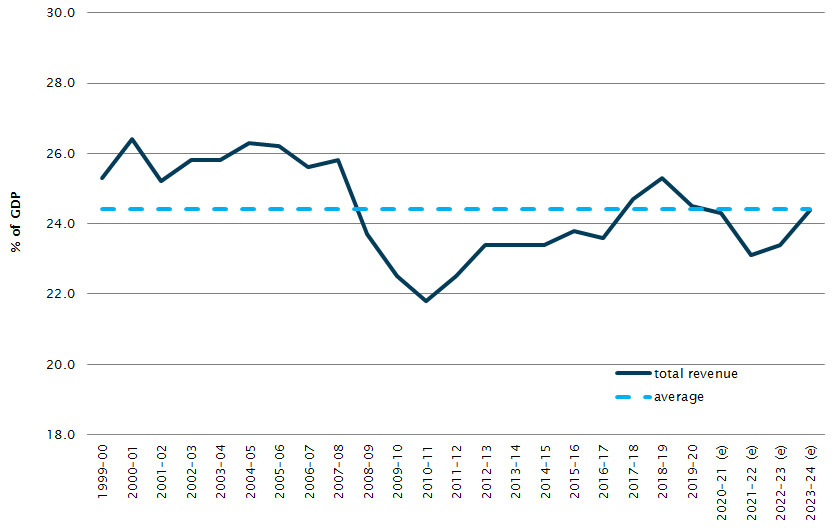

Australian Government Revenue Parliament Of Australia

Online Tax Return Australia Lodge Tax Return Tax Refund Irs Taxes Tax Season

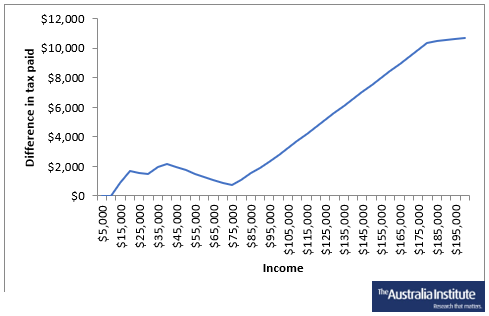

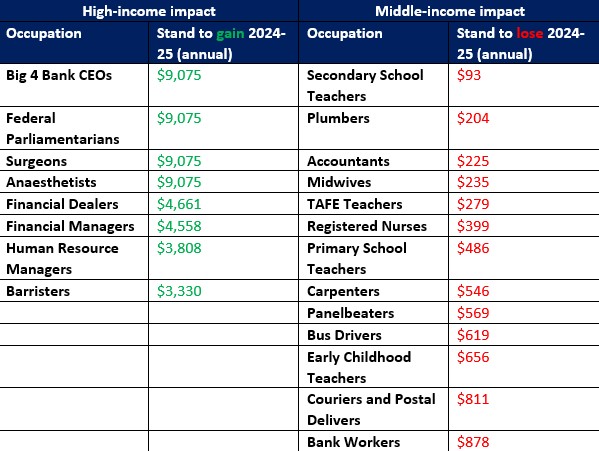

Stage 3 Tax Cuts Go To Wealthy Occupations Low Middle Income Earners Miss Out Report The Australia Institute

Australian Government Revenue Parliament Of Australia

Australian Government Revenue Parliament Of Australia

Ten Reasons Why The Arguments Against Increasing Tax Are Wrong The Australia Institute

Australian Government Revenue Parliament Of Australia

Australia Macquaire Proof Of Address Bank Statement Template In Word And Pdf Format Doc And Pdf Datempl Tem In 2022 Statement Template Bank Statement Templates